-

Consumer

-

Investing

- Investing basics

- Deciding how to invest

- Ethical investing

- Managing your investment

- Online investing platforms

-

Types of investments

- Bank regulatory capital

- Binary options

- Bonds

- Cash investments

- Crowdfunding

- Cryptocurrencies

- Derivatives

- Exchange-traded funds

- Foreign exchange trading

- Gold and other commodities

- Investment software packages and seminars

- Managed funds

- Peer-to-peer lending

- Property investment

- Property syndicates

- Shares

- Wholesale investments

- Getting advice

- Everyday finance

- KiwiSaver & Superannuation

- Unregistered businesses

-

Investing

-

Finance professionals

-

Services

- Accredited bodies

- Administrators of financial benchmarks

- Auditors

- Authorised body under a financial advice provider licence

- Client money or property services provider

- Climate Reporting Entities (CREs)

- Crowdfunding service providers

- Crypto asset service providers

- Directors

- Derivatives issuers

- Discretionary Investment Management Service (DIMS)

- e-money and payment service providers

- Financial advice provider

- Financial adviser

- Financial Institutions

- Financial market infrastructures

- Independent trustees

- Interposed persons under the financial advice regime

- Managed investment scheme manager

- Market operators

- Offer disclosure for equity and debt offers

- Offers of financial products

- Peer-to-peer lending service providers

- Supervisors

- Focus areas

- Legislation

- Licensed & reporting entities

- Online Services

-

Services

-

About

- People & leadership

- Board

- Regulatory approach

- Enforcing the law

- Investor capability

- Corporate publications

- Careers Document library

- News & Insights Document library

- Scams Document library

-

Contact

- When to contact us

- Make a complaint

- Official Information Act (OIA) requests

- Make a protected disclosure (whistleblowing)

- Frequently asked questions

24 September 2024

KiwiSaver Annual Report

The FMA publishes a report every year based on all providers’ statutory data for the year to the end of March. It summarises our activities as a regulator relating to KiwiSaver during the previous financial year.

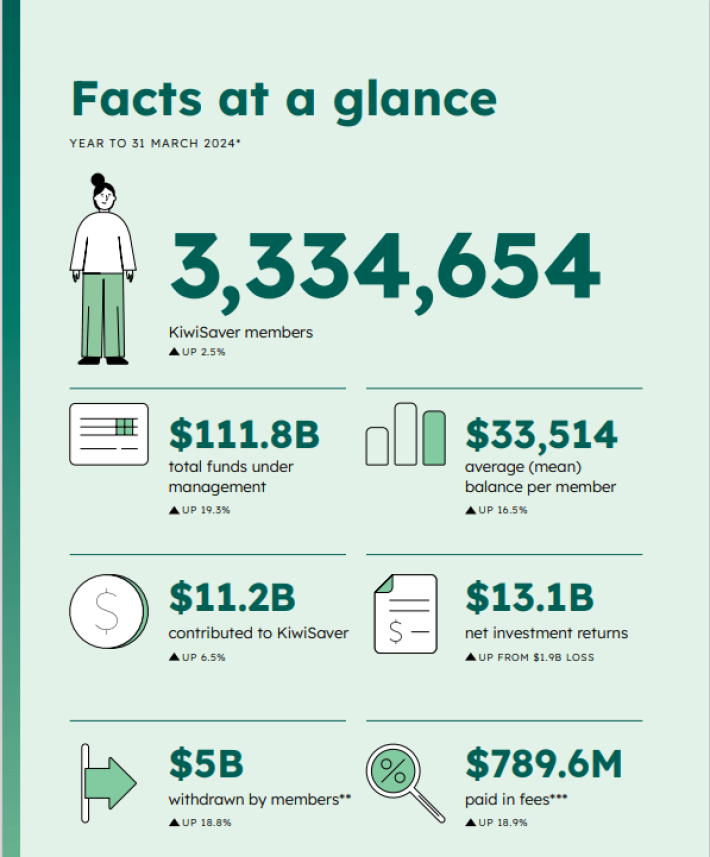

KiwiSaver Annual Report 2024: the year where KiwiSaver passes milestone of $100 billion of funds under management.

In its seventeenth year, KiwiSaver investments are working well for New Zealanders. Ending the financial year on $111.8 billion, there was a 19.3% increase from last years $93.6 billion funds under management.

The FMA is proud to report on KiwiSaver data annually. Promoting a fair, efficient and transparent KiwiSaver market is a priority, and this starts with us ensuring that all providers are focused on the best interests of their members.

John Horner

Kia ora listeners, welcome to the FMA podcast on the KiwiSaver Annual Report 2024. My name is John Horner. I'm the director of markets, investors and reporting at the FMA. I've been 20 years a lawyer and now I'm in the FMA being a regulator. Stuart.

Stuart Johnson

Thanks, John. My name is Stuart Johnson. I'm the chief economist of the FMA. Before I worked at the FMA, I spent about 20 years as an economist working in banks and insurance companies. And about 18 months ago, I turned my hand to regulation.

Stuart Johnson

So John, Why does the FMA produce this report?

John Horner

Look, a key purpose of the FMA is to promote fair, efficient and transparent financial markets, and so transparency requires us to collect this data from the providers, assess it, analyse it, write up a report and issue that out to the public for everybody to see.

Oh, and the KiwiSaver Act as well, requires us to write this report, table it in Parliament for our Minister.

Stuart Johnson

Fantastic. But John, what's in the report that listeners would be particularly interested in?

John Horner

Well, every year when the report comes around, Stuart, we're all looking to see what's happened and with contributions and the return on the investments in KiwiSaver. This year, the good news is we've cracked the $100 billion mark.

As at 31 March 2024, KiwiSaver funds under management in total were $111 billion and that's across 3.3 million KiwiSaver members. So with good returns, good contributions, the growth in KiwiSaver for that particular year was 19%. That's a good catch.

Stuart, what do you make of the numbers?

Stuart Johnson

I agree, John. It's been an excellent year for KiwiSavers.

You know that we always talk about the idea that investments can go up as well as down and we try and warn consumers of that as much as possible. But honestly, John, it's fantastic to see them go up. KiwiSaver has had an excellent year for investment returns.

I remember last year when we were talking about this idea that contributions had been more important in 2023 than investment returns, and now 12 months on, we see the complete opposite. We see that KiwiSavers have actually made more money in investment returns and they have put that into their KiwiSaver.

And that's fantastic evidence that KiwiSaver is working for its members. Members are saving and then those investments are growing further investments, really creating extra money for KiwiSaver members. So that's perhaps the biggest highlight for me.

John Horner

And that's just over a one-year period, Stuart? Should Members look over a longer term at the performance of their Kiwi Saver fund?

Stuart Johnson

Absolutely. KiwiSaver is a long-term investment. People are saving for their retirement and while year on year growth is important, people need to be in KiwiSaver for the long haul. You are saving over the course of your working life in order to have some money in retirement.

Tell me, John, what does it moving through that 100 billion and I mean, let's be honest, we didn't move through it. We crashed through it significantly. It's been fantastic. But what does that mean?

John Horner

Yeah look, 17 years in over $100 billion is a is a really good milestone, but it's still early days if we compare ourselves to your friends over the ditch, which you might have an accent along those lines. Australian Super Fund is that more like $4 trillion. And so they've been going at this a lot longer.

And we have contributing much more. And of course there are significantly larger population. So $100 billion is really good, but I call it a good start. We've got work to do.

KiwiSaver members individually need to be engaged with their KiwiSaver account. What's happening in it? Which fund are they in? Are they with the right provider? Keep a track on it. Talk to your friends about it, get advice from a licenced financial advice provider if you're unsure.

And really, really think about what sort of money do you need in your retirement and how are you going to get there. So I think after 17 years, we're getting more and more mature both as investors and KiwiSavers and also the providers, the businesses out there providing these services to KiwiSaver.

What's your view of the KiwiSaver regime in New Zealand after 17 years?

Stuart Johnson

So 17 years, John, it really represents a milestone for KiwiSaver. It's almost like a coming of age for the industry. You combine that with the 100 billion that we've talked about. KiwiSaver now has been with us for 17 years and that's fantastic. We've seen the investment returns. It's absolutely delivering for new members.

I've spent a fair bit of the year out talking to KiwiSaver providers and I've heard lots of stories about how they are managing people's money, how they are managing the risk associated with that, how providers governance are going, and some of those stories are really fantastic. And I can see members of the industry really doing a great job. Managing New Zealanders money. But 17 years? We need those very high levels of professionalism for all providers.

Stuart Johnson

Every single KiwiSaver provider needs to be meeting that very high mark of professionalism because remember, these providers are tasked with looking after New Zealanders, money and money that they are putting away for retirement. So 17 years and 100 billion is really important to me because I need to see that whole industry delivering very high levels of professionalism now.

The vast majority of firms are there, but we need to see that across the industry.

John Horner

Another key purpose of the FMA to ensure the trust and confidence in the financial market for financial services market in New Zealand is preserved. And that's for the benefit of all KiwiSavers.

Stuart Johnson

Absolutely.

Stuart Johnson

John, how many New Zealanders are actually KiwiSaver member?

John Horner

Yeah. Look, the number this year 3.3 million New Zealanders are in KiwiSaver now. They're not all contributing and that might be a factor of the tough economic times that the relatively low discretionary money people have.

But what we ask is that individual Members think about what their contribution status is. Can they put in more? Do they need to stop? If so, when can they get started again? Because as you pointed out, contributions are a really important part of the overall growth of KiwiSaver. So 3.3 million.

About a third of those are not contributing at all. That will include younger people who aren't contributing and perhaps those who are retired who are no longer contributing. And then there are a range of people who don't contribute for a bunch of reasons and that's fine so long as they're thinking about it and looking for the opportunities to contribute.

Stuart Johnson

Excellent. Tell me about the contributions this year. John, I've talked a little bit about the returns, but tell me about the importance that contributions play to KiwiSaver.

John Horner

Well, returns are volatile as you say they go up, they go down, contributions can be small, regular payments made, and they're in the control off the members the Kiwi. Over members themselves, of course, if you put in a sufficient contribution each year, you get that government contribution as well. Employers also have to contribute to match up to 3% of Kiwi saver invest.

So contributions are stable relative to last year, a little bit up, which is good. It's been difficult times. We'd like to see those contribution rates increase in future years.

So Stuart KiwiSaver members pay fees to the KiwiSaver providers. What does the data collected this year tell us about fees?

Stuart Johnson

John fees are really important and it's good that we're focusing on them. The data tells us that fees this year have increased 19%, so fees in 2023 were 664 million.

And this year, they've gone up to 790 million, but we just need to really think about what that means. Fees tend to be charged as a percentage of the funds under management and we've already talked about the idea that KiwiSaver and KiwiSaver balances have grown significantly In 2024, so we would expect more money to be collected in fees. However, as the industry grows, there's more money invested in KiwiSaver. We would also expect to see some economies of scale.

So, if we looked at 2023, we can see that on average, KiwiSavers paid $0.70 in fees for every $100 they have invested in. KiwiSaver. Can you tell me what that means for the individual KiwiSaver member? So, what that means for the individual Member is that however much money they have, they are paying that same rate of fees that $0.70 per $100 in 2023 and 2024. So we haven't seen any decrease in the level of the fees across the industry.

Stuart Johnson

Now for the individual KiwiSaver. What's really important is that they focus on their net return. Now net return is your investment returns minus the fees that you have paid and that's the best way of understanding if a KiwiSaver.

Is getting a good deal from their provider. Looking at that, that return that they have received the investment return and subtracting the fees that they have paid, now, John, we've got lots of providers in the industry. Some of those providers have relatively low fees, especially industry, especially tracking funds. So a fund that that tracks an index. Other providers have actively managed funds where a team of investment managers actively manage the money.

And they tend to be more expensive. So, we have some low fees and some high fees, but consumers really need to look at the net return. So that's the investment, the investment returns they've received taking away the fees. It's not enough to just look to see whether the fee is high or low.

They need to look at the net returns for their investment. And then if we go back up to an industry level, what we need to see is that those economies of scale coming through over time. Now, if we look at the industry level, fees have been falling over the last couple of years, but fees are the same. Between 2023 and 2024, so next year one of the things that we will be looking at are how the fees are going given the growth in KiwiSaver.

John Horner

At the FMA, we talk about value for money, right. So it's not about whether fees are high or low, it's about the value received in return for those fees. So transparency is really important. We wanna know what fees are being charged. We wanna know what services are being provided in return for those fees for Kiwi Saver members absolutely.

So in summary, 2024 for KiwiSaver annual report steady on contributions, really good returns 3.3 million New Zealanders involved in KiwiSaver. We think it's working pretty well across the board. If you need more information or you're looking for a copy of the report, go to www.fma.govt.nz and you'll find some more information there. Get engaged. Check your fund.

Do your contributions as much as you can and we'll see you next year for the 25 report. Ka Kite Ano.

Related

- KiwiSaver annual report 2023

- KiwiSaver annual report 2022

- KiwiSaver annual report 2021

- KiwiSaver annual report 2020

- KiwiSaver annual report 2019

- KiwiSaver annual report 2018

- KiwiSaver annual report 2017

- KiwiSaver annual report 2016

- KiwiSaver annual report 2015

- KiwiSaver annual report 2014

- KiwiSaver annual report 2013

- KiwiSaver annual report 2012

- KiwiSaver annual report 2011